Most trusts and some Wills have a provision in them that refers to an “antilapse statute.” What does this mean?

Most trusts and some Wills have a provision in them that refers to an “antilapse statute.” What does this mean?

The common law (before statutes) held that if your named beneficiary died before you, his or her share would “lapse” (expire) and get thrown back into the pot for the other living beneficiaries. Often that wasn’t the testator’s (the person who wrote the Will) intent. Often, if the deceased beneficiary was a family member, the testator would have preferred that the deceased beneficiary’s share be distributed to the deceased beneficiaries’ children.

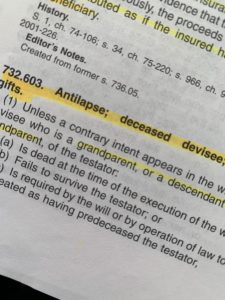

To avoid this result, Florida and some other states enacted “antilapse statutes.” Florida’s antilapse statute says that if the deceased beneficiary was the testator’s grandparent or a descendant of the testator’s grandparent, the gift won’t lapse – it’ll go to the deceased beneficiary’s children as long as there’s nothing in the document to the contrary. Of course, that means that if the deceased beneficiary was a friend or extended family member, the gift will lapse and that beneficiary’s children will get nothing.

Today, if you work with an estate planning attorney, she’s going to ask you what you want to happen if your named beneficiaries die. A good estate planning attorney isn’t going to rely on statutes – she’ll specify in the document exactly what should happen if that particular beneficiary dies before you. And because she specified what should happen, she’ll often add a provision to the Will or Trust stating that the Florida antilapse statute doesn’t apply so it won’t wreck your thoughtful plan.

Other articles you may find interesting:

Including Pets in Your Estate Plan