What happens when a beneficiary form – whether it’s on a TOD account, an IRA, life insurance, or an annuity – is different from what Mom or Dad wrote in their Will or Revocable Living Trust? Unfortunately, this often isn’t discovered until after Mom or Dad is dead. As this article mentions, generally, what’s on the beneficiary designation form trumps the Will or Trust, even if that wasn’t the intention.

I often hear Mom say “I just put my oldest daughter on my bank/investment account as a beneficiary because I know she’ll split it with the other kids.” Bad juju there. Maybe she would, but as soon as Mom’s dead, that money is legally 100% hers. She could buy a new house, put in a pool, travel to Italy and there’s nothing her siblings could do about it. Maybe she’s incapacitated and her husband is now controlling all of her assets as the Agent on her Durable Power of Attorney and he decides to (legally) use the money to buy a new car, fix the house, etc. Bye, bye inheritance. Or, she’s hit with divorce papers shortly after Mom dies. Oops, if she deposited that money into their joint bank account, it’s now a marital asset that will subject to the divorce.

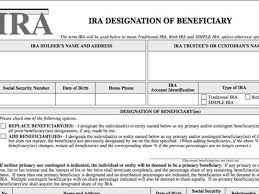

Beneficiary forms should be used very carefully and reviewed every couple of years because each institution’s rules about what happens if one of those named beneficiaries dies before inheriting is different. Never assume anything. And meet with an estate planning attorney to make sure you have an actual plan, not just a bunch of random documents that may work at cross purposes to each other.

Other articles you may find interesting:

What’s the Difference? Living Will, Health Care Surrogate, DNR

Would you like to learn more about estate planning, elder law, asset protection planning, probate, and Medicaid planning in an informal, no-obligation setting?

Sign up for one of our free, educational workshops here.